Stock Brokers and Platforms 2022

Compare the best stockbrokers and their online trading platforms to make sure you pick the most appropriate to your needs. Use the comparison of spreads, range of markets and platform features to decide what will help you maximise your returns. No single broker or brokerage can be said to be best at all times for everyone – where you should open a trading account is an individual choice.

All Featured StockBrokers

Read Review

HARGREAVES LANSDOWN

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

INTERACTIVE BROKERS

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

Latest Articles

The Investment Terms You Should be Familiar With

The ART of choosing the best financial advisor for you

Coronavirus and Investing

FIDELITY

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

SOFI

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

INTERACTIVE INVESTOR

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

DEGIRO

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

LYNX

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

QUESTRADE

- Please check and review all terms and conditions before applying.

Reputation

Tools

Fees/Costs

Overall Rating

How to Compare Brokers

Before you can find the best interactive brokerage for stock trading you should determine your own investing style and individual needs – how often will you trade, at what hours, for how much money and using which financial instruments.

Then when choosing between all the top rated trading brokers, there are several factors you can take into account. If you simply pick the cheapest, you might have to compromise on platform features.

There is no one size fits all when it comes to brokers and their trading platforms. The best brokerage will tick all of your individual requirements and details.

These are some of key points and areas to compare in this competitive market:

Costs

- Do they offer low commission rates? – As a day trader placing numerous trades intraday, low commissions over a long period will bolster your overall profit.

- Do they offer attractive margin rates? – If you can anticipate a return higher than the interest your paying on the loan, then generous margin rates will allow you to trade big with capital you don’t have to hand.

- Do they have a complicated fee structure? – Broker fees can rack up quickly. You need to look at the fine print to ensure you won’t get stung by hidden costs later down the line, such as when you want to withdraw your money. Having said that, the cheapest brokers for day trading usually make up that money in other areas, such as customer service.

- Will you need a minimum deposit?- Some brokers will require you to put down significant capital in order to open an account and start trading. For example, if you’re day trading at Interactive Brokers you’ll need to put down serious cash before you can get to work.

- Does the broker have a daily trading limit? – Some limits are imposed to protect against extreme volatility and market manipulation. But the Interactive Brokers day trading limit can be set by you to prevent you losing too much capital in one day.

- Do they offer different account types? – Different accounts will come with varying costs and attractive perks. For example, choose between Interactive Brokers day trading accounts and you can get lower commission fees, greater leverage and enhanced tools for technical analysis. Read more about Account types here.

Trading Platform Features

- Do they have high tech, informative tools for research and analysis? – You will need live price quotations, plus detailed charts and access to historical data will also help you trade smarter. The top 10 online brokers all offer a multitude of tools and resources.

- How quick and efficient is their order execution? This is massively important if you’re day trading, as just a few seconds could cost you serious cash. Whilst many virtual brokers offer real-time execution, there remains a slippage concern. This highlights the need to test drive your broker first.

- How user-friendly is their platform? – The trading platform provided by the broker needs to work for you. Most brokers offer several to choose from, some will tick the boxes for the average day trader, others will offer more advanced platforms for the veteran trader. Likewise, does it suit your hardware – is the platform compatible on Mac, PC, Linux, or whatever you use?

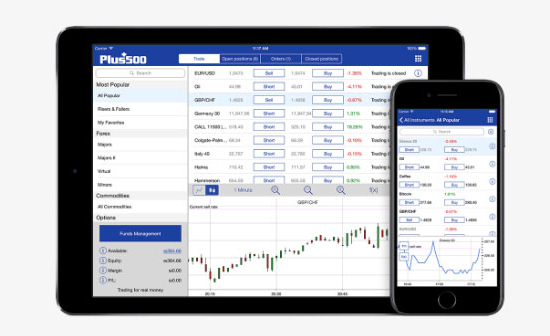

- Is there a Mobile platform? – It is rare for a broker not to deliver a mobile trading app, but the quality will vary. If trading on your mobile phone is important, then checking the apps compatibility (Android, iOS or Windows etc) will be vital.

Customer Service

- How good is their customer service? – Will you be able to quickly get in contact with someone when you need support or advice? This is particularly important if something goes wrong like a computer crash. Some brokerages offer 24/7 customer support, with call waiting times of less than one minute.

- Do they have a ‘dealing desk’? – The best brokers offer direct access. You don’t want to be sending an order to a train desk which then initiates it in the market. This is time-consuming and can result in re-quotes. By the time you’ve confirmed you want to proceed, your opportunity has probably vanished.

Extras

- Do they offer any attractive extras?– Any ‘Open Account’ promotions? £100 in free trades might not be everything, but it means you can iron out any creases in your strategy before it’s your money on the line. Trading without a broker means zero free credit for trial and error.

- Are there Account levels? Does a VIP account get free Level II data or reduced spreads?

- What returns do you get on your cash? – You’ll find you usually have something lying around in your brokerage account. Some brokerages won’t offer you a penny on that balance, but some will give you 3-5%.

- Trading Strategy – Can you implement your trading strategy, or even use automated trading, signals or copy trading at this broker?

Final Word On Comparing Brokers

Do your homework and make sure your day trading broker can cater to your specific requirements. It’s always worth giving your potential day trading broker a test. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. Get this choice right and your bottom line will thank you for it.

Need a short cut? Check out the winners of the broker-arena.com Awards this year.

What is a Trading Platform?

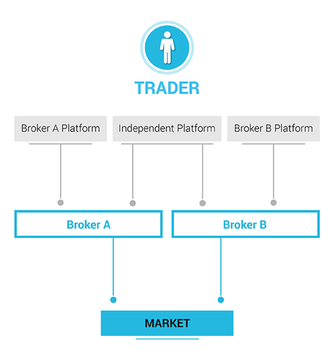

The trading platform is the software used by a trader to see price data from the markets and to place trade orders with a broker. Market data can either be retrieved from the broker in question, or from independent data providers like Thomson Reuters. In this section, we detail how to pick the best trading platform for you.

Normally a broker will offer their customers a branded trading platform that’s more or less unique to that individual broker, but there are also independent platforms that can connect to multiple brokers. An independent platform can be a good choice for the experienced trader, while using a broker’s own platform is the easiest way to get started for beginners.

Trading Platform Features

The best trading platform for you will have a combination of features to help the trader analyse the financial markets and place trade orders quickly. In particular, a top rated trading platform will offer excellent implementations of these features:

- Access to current and historic market data – A day trader needs to be notified of market price changes as soon as possible to be able to act before an opportunity is gone or a loss is materialised. Historic data is necessary for technical analysis and backtesting of trading strategies. Not all platforms have a backtesting feature though, so check before you commit to a specific software.

- Charting and other visual aids – Trends and market sentiment are best visualised through different charts and plotting of relevant technical indicators.

- Order execution – Once you have decided to place a trade, it needs to be executed on the market immediately. A great platform and broker will execute in less than a second. Traders that use automated trading want even faster execution, usually counted in milliseconds, depending on the strategy used and how price sensitive it is.

- Automated trading – A platform that offers automation capabilities enables a trader to make market moves even if he/she is not at the computer at the time. The classic “stop loss” feature is a simple form of automation, but there are much more advanced platforms that enable you to program your own trading robot to carry out elaborate strategies or to react much faster than you can do yourself.

- Broker Independence (optional) – You might want to become an expert on all the features of your trading platform but still have the option to change which broker you use. The solution is an independent trading platform (listed below), that can connect to several different brokers.

Independent Trading Platforms Comparison

An independent trading platform is used for visualising market data and managing your trading, but it needs to connect to one or more brokers to actually place a trade on the market.

These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing.

Using an independent trading platform you don’t have to relearn a whole new software just because you change to a different broker.

Independent platforms often come with advanced features such as enhanced charting and pattern analysis, automated trading and trading alerts/signals. Different platforms have different strengths.

Note – Not all brokers support this kind of integration with independent platforms, so use our reviews to find ones that do.

AlgoTrader

MetaTrader 4

MetaTrader 5

Trading Accounts

When choosing between brokers you also need to consider the types of account on offer. For example:

- Do they offer cash and/or margin accounts?

- Can you get managed accounts?

- Do they offer a single standard account or do they offer different account levels?

The account that is right for you will depend on several factors, such as your appetite for risk, initial capital and how much time you have to trade. With that said, below is a break down of the different options, including their benefits and drawbacks.

Cash Accounts

Most day trading brokers will offer a standard cash account. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. Most brokers will offer a cash account as their standard, default option.

Benefits

There are several benefits to cash accounts. Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain. Also, you have less risk than margin accounts because the most you can lose is your initial capital. Finally, you don’t have to pay the interest costs that come with margin accounts.

Drawbacks

Trading with a cash account also means you have less upside potential because there is no leverage. For example, the same gain on a cash and margin account might represent a 50% difference in returns because margin accounts require far less capital.

In addition, you have to wait for funds to settle in a cash account before you can trade again. At some brokers, this process can take several days.

Overall then, the absence of margin means these accounts probably aren’t the right fit for the majority of active intraday traders.

Margin Accounts

Most brokers will offer a margin account. Essentially, this allows you to borrow capital to increase your position size. For example, you may only pay half of the value of a purchase and your broker will loan you the rest.

Note brokers often apply margin restrictions on certain securities during periods of high volatility and short interest.

Local regulation may also impact the margin or leverage offered, for example the FCA in the UK have now said retail investors there are not able to trade cryptocurrencies on margin.

Benefits

Margin accounts come with several benefits. Firstly, you can choose when you pay back your loan, as long as you stay within maintenance margin requirements. Secondly, you can leverage assets to magnify your position size and potentially increase your returns.

Also, interest rates are normally lower than credit cards or a bank loan. Finally, if you have a concentrated portfolio, you may be able to use existing securities as collateral for a margin loan.

Drawbacks

Despite the benefits, there are serious risks. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. You also have interest charges to factor in.

In addition, you need to check maintenance margin requirements. If not, you could get short-squeezed resulting in forced liquidation from a margin call.

Overall then, margin accounts are a sensible choice for active traders with a reasonable tolerance for risk.

Managed Trading Accounts

Some brokers will also offer managed accounts. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. These might be referred to as an advisor on the account – these advisors have complete control of trades. There are two standard types of managed accounts:

- Pooled Funds – With this type of account your capital goes into a mutual fund along with other traders’ capital. The returns will then be distributed between the investors. Normally, brokers divide these accounts according to risk appetite. For example, those looking for large returns may put their funds into a pooled account with a high risk/reward ratio. Those looking for more consistent profits would probably opt for a safer fund. Minimum investments for pooled accounts are around $2000.

- Individual Accounts – With this account, your broker will manage your capital individually and make investment decisions tailored to your needs. The main benefit is having an experienced professional on your side. However, you will pay for that privilege with account maintenance fees and commissions. In addition, some brokers will impose high minimum investments of at least $10,000.

Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade. However, those with less capital and those with time or the inclination to enter and exit positions themselves may be better off with an unmanaged account.

Account Levels

Some discount brokers for day trading will offer just a standard live account. However, others will offer numerous account levels with varying requirements and a range of additional benefits.

For example, a Bronze account may be the entry level account. Here you may get access to chat rooms, a weekly newsletter and some financial announcements and commentary. These entry-level accounts normally have low deposit requirements.

If you were to deposit more, say over $1000 and make a certain number of trades each month, then you may be eligible for a Silver account. This may grant you access to courses, a personal account executive and more in-depth market commentary.

Deposit a bit more, $5000 for example, and you may be eligible for a Gold account. For this you could get:

- 10% deposit bonuses

- Daily market research

- Referral incentives

- A dedicated trading mentor

- Telephone access to an active trading community

Finally, some brokers will offer a top tier account, such as a VIP account. To qualify for this account you might need to deposit upwards of $20,000. You may also need to trade 500 lots quarterly, for example.

However, for your larger deposit, you might get even more hands-on help, as well as greater deposit bonuses, free trades and other financial incentives. You may also get full access to a wide range of educational and technical resources.

So, the best day trading discount brokers will offer a number of account types to meet individual capital and trade requirements. It’s also worth bearing in mind that generally, the more you can invest the greater the perks and trading experience.

Final Word on Accounts

When choosing between brokers, you need to consider whether they have the right account for your needs. The main factors to consider are your risk tolerance, initial capital and how much you will trade.

Note you can also open different accounts if you want to use several different strategies.

Regulation And Licensing

One key consideration when comparing brokers is that of regulation. There are a number of different regulatory bodies around the world. Reputation of these authorities varies, but almost all can give consumers a high level of confidence in the brokers they license. Here are some of the leading regulators;

FCA (Financial Conduct Authority) – UK regulator, with responsibility for all forms of trading and market speculation.

CFTC (Commodity Futures Trading Commission) – US Regulator overseeing broker.

SEC (Securities and Exchange Commission) – US regulator for exchanges and markets.

FSB (Financial Services Board) – South African Regulator

CySEC (Cyprus Securities and Exchange Commission) – Cypriot regulator, often used to ‘passport’ regulated brands across Europe

BaFin (The Federal Financial Supervisory Authority / Bundesanstalt für Finanzdienstleistungsaufsicht) – German regulator

Financial Supervisory Authority Denmark (Finanstilsynet)

The European Securities and Markets Authority (ESMA) also offers an over-arching guide to all European regulators, imposing certain rules across Europe as a whole – including leverage caps, negative balance protection, and a blanket ban on binary options. These rules only apply to retail traders, not professional accounts.

How to Try a Broker for Free

A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. A demo account is funded with simulated money, so you can try out the broker’s platform features and get familiar with acting on the markets.

A warning though – even the best practice platform can’t replicate the pressures that comes with having real money on the line, but it’s a great way to learn the basics and get started with zero risk.

How Brokers Make Money

Even among the best brokers for day trading, you will find contrasting business models. Having said that, there are two main types:

- Market Makers

- Over-the-counter (OTC) brokers

Market Makers

Some of the best brokers for day trading online are market makers. Market makers are constantly ready to either buy or sell, so long as you pay a certain price. That means they may lose out in price shifts before they find a buyer/seller.

But, of course, for taking that risk, they seek compensation. So they set the bid price marginally lower than listed prices while setting the ask price slightly higher. That tiny margin is where they will make their money.

Now that may seem like an insignificant amount. However, tens of thousands of trades are placed each day through good brokers for day trading that use these systems. Unsurprisingly, those minute margins can quickly add up.

Note day trading brokers using this model normally offer either fixed or variable spreads:

- Fixed spreads – Do not change, regardless of what is happening in the markets. Due to the additional risk, fixed spreads tend to be wider than variable spreads.

- Variable spreads – Fluctuate in response to market conditions. For example, during the London and New York overlap, an increase in liquidity leads to tight spreads.

Let’s take a look at an example – if you want to sell 50 shares of Tesla, good market makers will buy your shares, regardless of whether they have a seller lined up yet. However, they may buy those Tesla shares for $300 each (the ask price), while offering to sell them to another trader for $300.05 (the bid price). That $0.05 is where your online broker is making their money.

OTC Brokers

Many of the best discount brokers for day traders follow an OTC business model. In fact, they are the most popular type of day trading broker.

The immediate lure is the apparent lack of trading costs and commissions. However, on the best day trading platforms, it isn’t quite that simple.

Essentially, an OTC day trading broker will act as your counter-part. They will take the opposing side of your position. As a result, you don’t have to pay a commission or fees in the same way. You are simply trading against the broker.

The best OTC futures or CFDs brokers, for example, may have both sides of the trade covered, promising a handsome margin. However, some of best brokers for day trading may also hedge to offset risk.

The Comparison

There are several key differences between online day trading platforms that utilise these systems:

- Increased liquidity – Effectively the best brokers that follow the market maker model act as wholesalers, buying and selling to meet the needs of the market.

- Costs – Without market makers, finding buyers and sellers may take longer. As a result, liquidity may drop and you may pay higher trading fees as entering and exiting positions becomes harder.

- Motivation – A market maker will make money regardless of the outcome of your trade. Whereas an OTC broker has a vested interest in you losing out.

The top brokers for day trading will often use a variation of one of these models. Check reviews to see which model a prospective broker is using to get a feel for where and how they expect to make their profit.

Broker Payment Methods

Different trading brokers support different deposit and withdrawal options. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods.

For some traders it might be essential that a deposit or withdrawal is instantaneous, while others are fine with a processing time of a few days. Any trader making frequent deposits or withdrawals surely wants to look out for low transaction costs.

Cryptocurrencies are one payment method where brokers take very different views.

Trading In Different Regions

With the world migrating online, in theory, you could opt for trading brokers in India or anywhere else on the planet. However, there are tax considerations and regulations worth keeping in mind before you choose trading platforms in Australia, Singapore or anywhere outside your country of residence.

- Tax considerations – Where you trade and where your broker is situated may affect what type of tax and how much tax you will have to pay. Will you pay capital gains tax? Will you pay net income tax? If you start day trading with brokers from Canada, will you pay tax abroad and domestically? If you’re thinking of signing up with a far afield broker, find out the tax ramifications first.

- Regulation – Regulation is important for a number of reasons, but your financial security is one of them. Opt for brokers regulated in well established financial systems, like the EU, USA or UK. A broker regulated in Bermuda is better than no regulation at all, but you may still encounter issues.

Canada and the US also have pattern day trading rules – but both are quite separate. Read more about this on the rules page. Just note that Canadian day trading platforms may differ significantly from both US or European versions, and platforms in South Africa will vary also.

With the world migrating online, in theory, you could opt for day trading brokers in India or anywhere else on the planet. However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore or anywhere outside your country of residence.

- Tax considerations – Where you trade and where your broker is situated may affect what type of tax and how much tax you will have to pay. Will you pay capital gains tax? Will you pay net income tax? If you start day trading with brokers from Canada, will you pay tax abroad and domestically? If you’re thinking of signing up with a far afield broker, find out the tax ramifications first.

- Regulation – Regulation is important for a number of reasons, but your financial security is one of them. Opt for brokers regulated in well established financial systems, like the EU, USA or UK. A broker regulated in Bermuda is better than no regulation at all, but you may still encounter issues.

Canada and the US also have pattern day trading rules – but both are quite separate. Read more about this on the rules page. Just note that Canadian day trading platforms may differ significantly from both US or European versions, and platforms in South Africa will vary also.